You take part in a global marketplace where cross-border payments play a key role. These transfers connect buyers and sellers from different countries. In 2024, the global cross-border payments market is valued at $196.35 billion and is expected to reach $303.34 billion by 2030, growing at a rate of 7.43% each year.

- In emerging markets like the UAE, you face complex regulations, developing infrastructure, and changing consumer expectations.

- Chargebacks in the UAE can create extra challenges for merchants who rely on secure payments and smooth cross-border transfers.

Key Takeaways

- Cross-border payments are crucial for global commerce, with the market projected to grow to over $303 billion by 2030.

- Chargebacks pose significant financial and operational risks, especially in emerging markets like the UAE, where they can hinder global expansion.

- To reduce chargebacks and fraud, implement strong compliance measures, use localized payment methods, and leverage technology like AI-powered fraud prevention.

- A cross-border payment provider with both global reach and local expertise, such as PayerMax, can simplify operations and protect your business from risk.

- The right international payment partner provides tools for security, unified reporting, and chargeback management, enabling businesses to scale internationally with confidence.

Understanding Cross-Border Chargebacks

How Chargebacks Work in International Transactions

Cross-border payments involve complex factors—different currencies, banking systems, and time zones—which increase delays and risks. Chargebacks occur when customers dispute payments, requiring refunds and potentially incurring fees. Currency fluctuations and heightened fraud risks, especially in Asia-Pacific, further complicate these transactions.

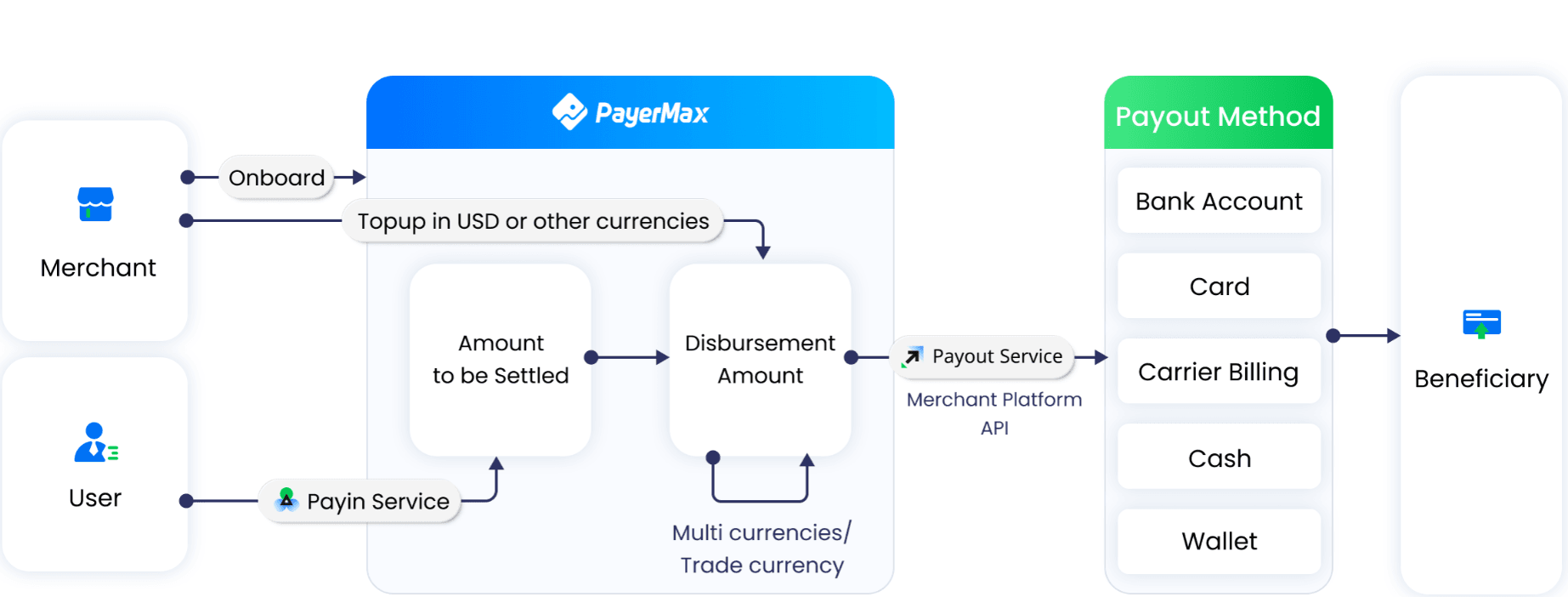

PayerMax simplifies cross-border payments, supporting 70 currencies and 600+ local methods across 150+ countries and regions. Its global acquiring, real-time monitoring, and risk management tools help prevent fraud and ensure smoother, more secure international transactions.

Why Emerging Markets Present Higher Risks for Merchants

While emerging markets offer significant growth opportunities, they also present complex challenges for cross-border payments. Businesses must navigate evolving regulations, which can cause delays and penalties. Settlement delays and foreign exchange volatility further impact cash flow.

Fraud is also a major concern due to complex financial environments. Additionally, local logistics issues in regions like Southeast Asia can lead to chargebacks, while complex issuer requirements in the Middle East, including the UAE, complicate dispute resolution.

PayerMax addresses these challenges with deep local expertise and strong payment channel relationships. Its platform simplifies compliance and regulatory documentation while powerful risk management tools help detect fraud and reduce chargebacks. This allows businesses to expand with confidence, knowing PayerMax is handling the complexities of international payments.

Regional Challenges in Emerging Markets

Middle East Focus – UAE

Managing cross-border payments in the UAE is complex due to strict and evolving regulations. Businesses must navigate new VAT and corporate tax rules, which directly affect financial planning, operational strategies, and profitability. Compliance is crucial, as errors can lead to fines, reputational damage, and lost opportunities.

Key Impacts of UAE Tax Regulations on International Business:

- Financial Planning & Profitability: VAT and corporate tax influence budgeting, cash flow, and investment strategies.

- Compliance & Operations: Meeting timely filing and reporting standards is essential to avoid penalties and adapt business operations.

- Reputation & Investor Confidence: Strong compliance builds trust and signals transparency, enhancing business reputation and attracting investors.

Additionally, meticulous record-keeping for remittances and chargebacks is necessary to prevent delays and disputes. Solutions like PayerMax provide tools to streamline these processes, helping businesses maintain smooth, compliant operations within the UAE’s regulatory environment.

Southeast Asia (Singapore, Indonesia, Philippines)

In Southeast Asia, you encounter different cross-border challenges. Logistics issues often cause chargebacks, especially in e-commerce. Customers may not receive goods on time, leading to disputes and remittances problems. Each country has its own regulations for international trade and payments. You must stay updated on changing rules to avoid compliance issues.

PayerMax helps you navigate these challenges. The platform offers local expertise and strong support for regulation compliance. You get access to documentation and guidance for each market, reducing the risk of failed payments and chargebacks.

The True Cost of Cross-Border Chargebacks

Direct Financial Losses from Cross-Border Payments

Cross-border payments in the UAE and Southeast Asia carry significant financial risk. Each chargeback results in lost revenue and additional dispute fees. Currency conversion (1–4%) and cross-border transaction fees (0.5–2%) can push total settlement costs to 3.5–5.5% for high-volume international transactions.

Operational complexity increases due to fluctuating exchange rates and differing chargeback rules across card networks, heightening the risk of friendly fraud.

Mitigation Strategies: Monitor transactions for fraud, maintain clear sales records, and use invoice management systems to track payments and disputes. PayerMax’s advanced anti-fraud solutions help detect high-risk users, protecting revenue and minimizing losses.

Operational Burden of Managing Chargebacks

Managing cross-border chargebacks is time-consuming and resource-intensive. Each case requires collecting documents, responding to banks, and following up diligently. These tasks can slow operations and divert your team from other priorities. Complicating matters further, rules differ by country and payment network—and they change frequently, adding to the complexity.

Key operational challenges include:

- Handling currency conversions and monitoring exchange rates.

- Complying with region-specific chargeback regulations.

- Preparing and submitting evidence promptly.

- Organizing documents, often requiring e-invoicing solutions.

Cross-border chargebacks also carry higher operational costs than local disputes, with increased fees and time investment, which can impact profits and growth.

Technology can help streamline this process. Solutions like PayerMax offer real-time risk updates and adaptive fraud detection, automating parts of dispute management. E-invoicing further ensures records are well-organized and ready for any chargeback.

Staff training is crucial. Educated employees can identify risks early and apply the right strategies to prevent chargebacks, reducing both operational burden and financial impact.

Reputation and Market Entry Risks

Chargebacks can damage reputation and limit market expansion, particularly in the UAE. A high chargeback rate signals risk to payment processors, potentially triggering penalties or account restrictions. Frequent disputes also undermine customer trust.

Best Practices to Protect Reputation:

- Confirm customer orders to avoid misunderstandings.

- Provide responsive customer service to resolve issues before escalation.

- Use clear billing descriptors to ensure charges are recognized.

- Implement strong authentication like 3D Secure 2.0 to prevent fraud.

How PayerMax Helps:

PayerMax offers a comprehensive anti-risk system, including custom defense strategies, advanced model layering, and multi-dimensional black/white lists. These tools help balance risk and revenue while ensuring secure transactions for loyal customers.

Pro Tip: Regular staff training and strong internal policies empower your team to prevent fraud and manage disputes effectively. Employees familiar with cross-border payment risks can leverage the right tools to safeguard your business.

Strategies to Reduce Chargebacks in Emerging Markets

Localized Payment Methods and APMs

Offering payment methods familiar to customers reduces friction and disputes.

Popular Local Options:

- Southeast Asia: Bank transfers, PromptPay, FPX; alternatives: GoPay, MoMo, GrabPay, PayPal, Skrill, Neteller

- Middle East (UAE): Local bank transfers; alternatives: CashU, STC Pay

Localized payment gateways cater to regional preferences, increasing transaction completion and lowering chargeback rates.

Strengthening Evidence and Compliance

You need strong compliance measures to defend against chargebacks in cross-border transfers. The table below lists some of the most effective steps:

| Compliance Measure | Description |

|---|---|

| Robust Security Protocols | Use 3D Secure, AVS, and CVV checks to stop fraud before it starts. |

| Fraud Detection System | Spot and block suspicious transfers before they become a problem. |

| Transaction Documentation | Keep detailed records to prove each sale and delivery. |

You should also use e-invoicing and clear policies. These tools help you manage remittances and cross-border payments. With PayerMax, you get templates and support for compliance, making it easier to meet UAE regulations.

Fraud Prevention Technologies with Regional Adaptation

Fraud prevention must fit local needs. In emerging markets, you face unique challenges like outdated security and fast digital growth. Fintech companies now use AI to spot fraud before transfers happen. They check customer behavior and monitor transactions in real time.

- AI can detect fraud before payment execution.

- Historical data and customer profiles help calculate risk scores.

- Continuous monitoring finds suspicious activity quickly.

PayerMax’s API integration and hosted payment page give you real-time alerts. These solutions help you stop up to 90% of chargebacks before they start. Automation and analytics also improve your win rates in disputes and make your e-invoicing solution more efficient.

Case for Localized Support and Global Reach

Importance of Local Teams for Dispute Resolution

Local experts understand language, culture, and regulations, enabling fast dispute resolution. Merchants using PayerMax’s local teams saw dispute win rates increase from below 11% to over 56%, with some reaching nearly 87%, demonstrating how expertise protects revenue and reputation.

Navigating Regional Regulations and Licensing

Payment providers in the UAE and Southeast Asia require local licenses to operate. Licenses enable acceptance of local payment methods and faster payouts, while ensuring compliance and operational efficiency. Advanced security tools and transparent pricing build trust and meet regulatory standards.

Partnering with Global Cross Border Payment Providers

When expanding globally, managing cross-border payments can be complex, and chargebacks pose a significant threat. These disputes are more than just a financial loss; they create operational burdens and can damage your reputation in key markets like the UAE. To succeed, you need a partner that combines global reach with deep local expertise to offer tailored solutions that fit your industry's specific needs.

A comprehensive payment gateway provides essential tools, including robust security, real-time transaction monitoring, and AI-powered fraud prevention. This technology frees you from the burden of manual dispute management.

This is where a provider like PayerMax comes in. By offering a vast network of over 600 payment methods and powerful risk management tools, PayerMax helps you navigate the global marketplace securely. A strategic partnership like this allows you to scale your business internationally with confidence, knowing your chargeback risks are well under control.

FAQ

What is an example of a cross-border transaction?

A cross-border transaction is when a buyer and seller are in different countries. For example, a customer in the UAE purchasing goods from an ecommerce payment system based in Singapore is a common cross-border transaction.

Can you dispute a charge from another country?

Yes, you can dispute a charge from another country. This process is called a cross-border chargeback. It can be more complex due to different regulations, banking systems, and time zones.

Why do chargebacks cost more in emerging markets?

You pay more because of extra fees, currency changes, and longer settlement times. You also spend more time collecting documents and responding to disputes.

How does PayerMax help with chargeback management?

PayerMax offers risk management, anti-fraud tools, and local support teams. You get real-time alerts and help with compliance. This makes it easier to defend against chargebacks.

What documents should you keep for chargeback disputes?

Keep invoices, delivery proofs, customer communications, and transaction records. These documents help you respond quickly and win disputes.