For live streaming companies and e-commerce platforms making frequent, small-value, multi-currency payments to thousands of streamers, affiliates, or vendors, traditional payment systems often fail to scale.A global payout solution, accessed via a single API or payment gateway, simplifies nternational payment processing, ensures compliance, and reduces operational costs.

Key Takeaways

- Automate your global mass payments to reduce errors, save time, and handle more transactions efficiently, helping your business grow faster.

- Use global payment platforms that offer real-time tracking and strong compliance tools to keep your payments secure and meet international regulations.

- Integrate local payment methods to improve recipient satisfaction, speed up transactions, and expand your reach in different markets.

Key Challenges in Global Mass Payments

Currency and Multi-Currency Management

Handling mass payments across borders brings challenges like fluctuating exchange rates, high conversion fees, and hidden costs that can erode your revenue. Constantly monitoring rates to protect your profit margins and reconciling payments across currencies creates an administrative burden. To combat this, you need a global payout platform that can adapt to these changes and optimize your payment processing.

Compliance and Security Concerns

Global mass payouts require strict adherence to regulations like AML and KYC standards. Failing to meet these standards can result in financial penalties, legal fees, and reputational damage. Payment fraud is a major risk, with threats including account takeover, identity theft, and wire transfer fraud. You can reduce these risks by using automated compliance tools, transaction monitoring, and strong security measures.

Manual Processing Limitations

Manual processing of mass payments limits efficiency and scalability. You spend more time on data entry, approvals, and error correction, which increases operational costs and slows down payout cycles. Automated systems reduce error rates by up to 80% and cut processing times from weeks to days, allowing your team to handle three times the invoice volume without extra staff. This improves cash flow, compliance, and cost-efficiency in cross-border payments.

Seamless Bulk Payment Processes with Global Payout Solutions

Payment Automation Solutions

You can transform your global mass payouts by adopting advanced payment automation solutions. Platforms like PayerMax provide advanced global payout solutions that enable cross-border payments through automation, allowing you to send funds to thousands of recipients with just a few clicks. By integrating with a reliable payment gateway Singapore or payment gateway UAE, you can support multiple currencies and payment methods efficiently.

| Key Feature | Description |

|---|---|

| Global Mass Payments | Supports payments in multiple currencies and methods, enabling international transactions. |

| Supplier Onboarding Compliance | Ensures proper documentation and tax form collection for regulatory adherence. |

| Automated Invoice Processing | Uses automation to reduce manual input and speed up payment cycles. |

| Strategic Payment Timing | Optimizes cash flow by scheduling payments effectively. |

| Detailed Reconciliation & Reporting | Provides transparency and financial control through comprehensive reports. |

| Integration Capabilities | Connects with ERP and accounting systems to streamline workflows. |

| Security & Compliance | Implements encryption, multi-factor authentication, and regulatory adherence. |

| Flexibility in Payment Methods | Supports diverse payment types including bank transfers, e-wallets, and mobile payments. |

| Scalability | Cloud-based solutions that grow with business needs. |

| Vendor Management | Self-service portals and onboarding tools to improve supplier relationships. |

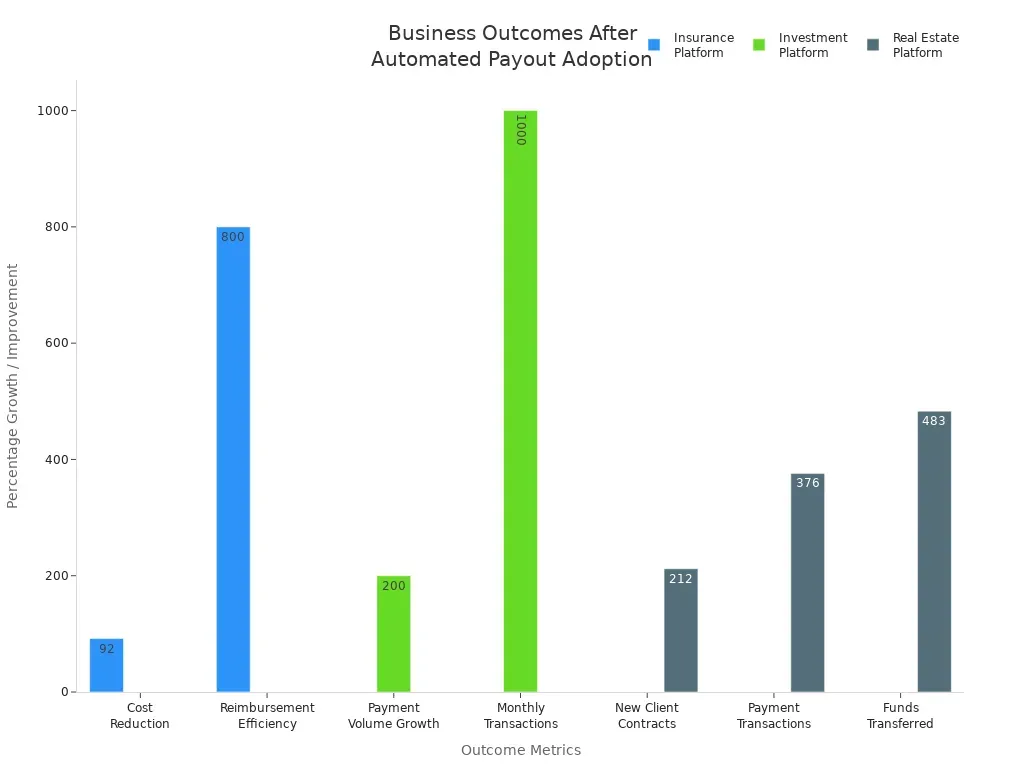

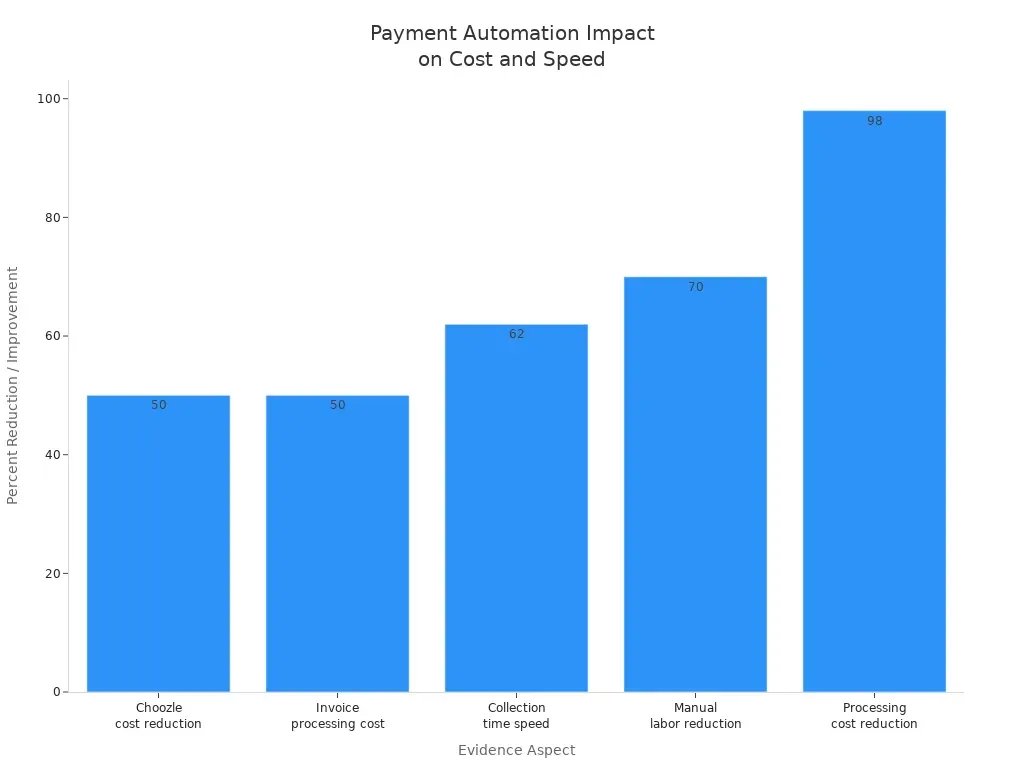

You gain significant operational benefits by automating batch payment processing. For example, companies have reduced invoice processing costs by up to 50% and cut manual labor by 70%. Automation also speeds up payout cycles, with some businesses accelerating collection time by 62%. These improvements help you deliver timely and accurate payments to your suppliers and streamers.

Real-Time Tracking and Transparency

When you manage global payouts, real-time tracking becomes essential. Modern mass payout systems provide live updates on each transaction, so you always know the status of your payments. Automated notifications alert you to successes, delays, or failures, helping you respond quickly to any issues. You can download detailed logs and reports for reconciliation, which supports audit readiness and financial accuracy.

Real-time tracking offers live updates on each payment, giving you clear insight into your financial operations.

- Automated notifications inform you about payment statuses, such as successes or delays.

- Reconciliation tools allow you to download logs and reports, ensuring accuracy and audit readiness.

- Real-time messaging lets both sender and recipient identify payment details instantly.

Technologies like real-time payment rails and AI-powered fraud detection further enhance transparency and security. These systems operate 24/7, including weekends and holidays, so your bulk payments reach recipients faster and with greater confidence.

Localized Payment Method Integration

Integrating localized payment methods is a key feature of modern global payout solutions, helping you expand reach and improve recipient satisfaction. This approach increases trust and satisfaction among your recipients, especially in regions with low credit card penetration.

- Local payment methods expand your market reach and improve user experience.

- Customers can pay or receive funds in their native currency, reducing declines and improving comfort.

- Local acquiring banks process transactions faster and at lower cost, saving you money.

- Settlement times are often same-day, improving your cash flow.

- Localized payment options help you comply with regional regulations and reduce legal risks.

| Region | Localized Payment Method(s) | Adoption/User Satisfaction Data |

|---|---|---|

| Brazil | Pix | Used by 76.4% of the population (over 155 million people) |

| United Arab Emirates | PayBy | ranking as a top-tier payment app |

| Singapore | PayNow | Used by over 65% of Singaporeans for one-time and recurring payments. |

| Philippines | GCash, Maya (formerly PayMaya), DragonPay | Used by over 67% of Filipinos, with GCash and Maya holding more than 80% market share |

Payment localization reduces cart abandonment and increases conversion rates. For example, a global entertainment company saw a 35% increase in transaction volume after integrating Alipay. Netflix tripled revenues in regions with low credit card use by adopting local payment methods. By supporting local preferences, you build stronger relationships and improve retention.

Built-in Compliance and Risk Management

Managing compliance and risk is essential for global mass payouts. Leading platforms like PayerMax offer built-in compliance modules that centralize governance, risk management, and audit processes. AI-powered analytics monitor transactions in real time, flag suspicious activity, and adapt to regulatory changes, reducing fraud and human error.

Key features include real-time dashboards, customizable workflows, automation of repetitive compliance tasks, and regulatory intelligence to stay updated on evolving laws. Embedding these capabilities ensures secure, scalable, and efficient mass payout operations.

Next Steps:

- Define your business needs.

- Prioritize compliance and security.

- Focus on technical integration and continuous optimization.

FAQ

How can you save money when making mass payments to recipients in different countries?

To reduce costs, use a platform that offers real-time exchange rates and transparent fees. Integrating local payment methods can also lower transaction fees and help you avoid expensive wire transfer charges.

How do global payment platforms help you stay compliant with international regulations?

Leading platforms have built-in compliance tools that automate tasks like KYC and AML checks. We also provide real-time monitoring and reporting, helping you screen transactions for suspicious activity and stay compliant with constantly changing laws.

Is it possible to pay thousands of recipients at once, and how do you get started?

Yes, modern global payout solutions allow you to pay thousands of recipients at once, typically via a single file upload or API integration. To get started, you'll need to create an account, onboard your recipients, and then upload your first payment batch.