A global payment gateway securely connects customers and merchants worldwide by encrypting data, authorizing transactions, and ensuring compliance with standards like PCI-DSS and GDPR. The market is growing rapidly, reflecting the rising global demand for seamless digital commerce.

Key Takeaways

- Strategic Alignment: Align your chosen global payment gateway with your specific business type, customer demographics, and payment habits.

- Comprehensive Evaluation: Compare fees, security protocols, and integration ease to ensure seamless and cost-effective transactions.

- Diverse Support: Prioritize platforms that support a wide range of global payment methods and currencies to maximize customer reach and satisfaction.

Introduction to Online Payment Gateways

What is an Online Payment Gateway?

A global payment gateway securely connects customers and merchants worldwide, enabling fast and efficient international transactions. Acting as an intermediary, it encrypts sensitive payment data, authorizes payments, and ensures compliance with standards such as PCI-DSS and GDPR, supporting seamless cross-border payment platforms. Core functions include secure fund transfer, integration with banks and processors, regulatory compliance, encrypted data transmission, and fraud prevention—essential for businesses operating online. Many gateways also support local card acquiring, a wide range of global payment methods, and advanced features like an instant payout payment gateway, helping merchants expand globally while ensuring smooth and secure transactions.

What is the purpose of the Global Gateway?

A global payment gateway enables businesses to securely accept payments worldwide, supporting multiple currencies and diverse payment methods—critical for e-commerce and gaming industries.

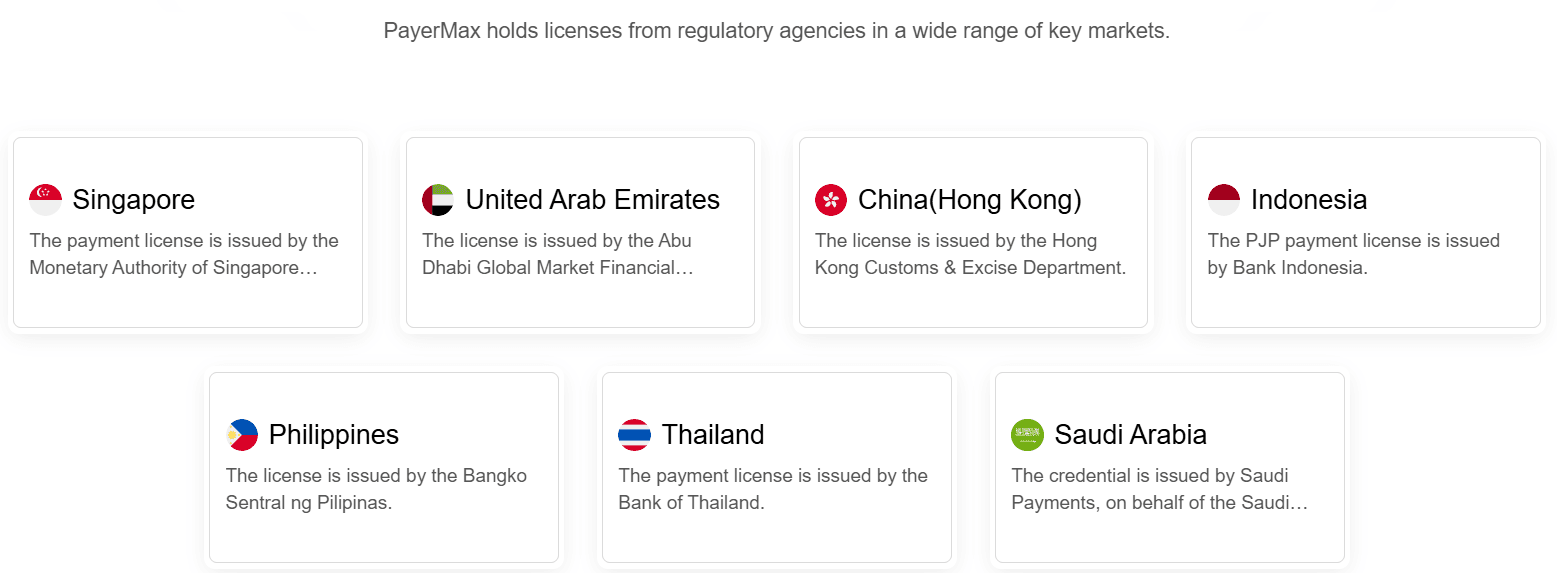

PayerMax offers an omni-method solution with global acquiring, global payout, and global collection services. Licensed in key markets like Singapore, the UAE, and the Philippines, and with offices in 17 countries, PayerMax provides a secure, convenient, and one-stop payment experience for businesses expanding globally.

Choosing the Right Payment Gateway for Your Business

Key Features and Evaluation Criteria for Businesses

To operate successfully online, businesses should evaluate key features when selecting a global payment gateway, particularly for e-commerce and live streaming platforms:

Security: Ensure PCI-DSS compliance to protect cardholder data and prevent fraud.

Payment Method Diversity: Support for credit cards, digital wallets, and local card acquiring methods is crucial for cross-border transactions.

Integration Ease: Quick integration with platforms like Shopify or WooCommerce improves user experience.

Transparent Pricing: Clear fee structures support accurate financial planning.

Reliable Support: 24/7 responsive customer service ensures smooth operations.

Scalability and Global Reach: The gateway must handle peak volumes and support multiple currencies, ensuring smooth international expansion.

Chargeback Handling: Strong dispute management minimizes financial risks.

Security, Compliance, and Transaction Efficiency

Security is paramount in payment processing. PayerMax safeguards sensitive data with PCI DSS Level 1, ISO 27001, advanced encryption, and AI-powered fraud detection. Real-time monitoring and fraud prevention measures help build trust and protect both businesses and customers.

Scalability and Multi-currency Support

A scalable payment gateway enables businesses to handle peak sales seasons without performance issues. PayerMax provides high system stability, supporting rapid transaction growth and ensuring operational continuity. Its multi-currency capabilities—covering more than 70 currencies with local settlement options—simplify global expansion by reducing exchange losses and enhancing the customer payment experience.

This consolidated approach helps businesses make informed decisions, ensuring they select a gateway that meets operational, financial, and security requirements while supporting global expansion.

Why Choose a Premium Payment Gateway Provider?

Who benefits from Global Gateway?

Global payment gateways benefit businesses of all sizes. PayerMax, with its coverage of 150 countries and regions, supports e-commerce platforms, live streaming services, and gaming companies in expanding internationally. Its comprehensive services—including acquiring, payout, and fund management—enable businesses to manage global transactions efficiently and grow across regions.

Which payment gateway works worldwide?

Many global payment gateways exist, but effectiveness depends on the regions targeted. A truly worldwide solution, like PayerMax, combines local card acquiring, multi-currency support, and localized payment options to ensure high transaction success and a smooth customer experience.

PayerMax provides a unified fund management dashboard, automated routing, and self-service reporting, reducing errors and enhancing financial transparency. Its flexible integration—via API, components, or PayByLink—simplifies setup and allows businesses to customize payment workflows efficiently.

Advanced Security and Compliance

Security is non-negotiable for a global payment gateway. For merchants seeking top-tier protection, PayerMax delivers advanced data encryption, two-factor authentication, and PCI DSS Level 1 certification. Its AI-powered fraud monitoring provides real-time oversight, reducing the risk of fraudulent activity. Additionally, PayerMax ensures compliance with international regulations such as GDPR and AML/KYC, reinforced by continuous audits and penetration testing.

How much does global payments payment gateway charge?

The cost of a global payment gateway varies significantly based on several factors: the provider, the transaction volume, the specific services utilized, and the types of payments accepted. Most providers charge a percentage of the transaction value plus a small fixed fee per transaction. Other potential costs include:

Setup Fees: Some gateways charge a one-time fee to get started.

Monthly Fees: A recurring fee may be charged for access to the platform and its services.

Chargeback Fees: A penalty is often charged for each chargeback received.

Currency Conversion Fees: An additional fee may be applied to convert currencies for cross-border collection.

PCI Compliance Fees: Some providers charge extra for maintaining PCI compliance.

It is crucial to request a detailed breakdown of all fees and compare pricing models from different providers before making a decision. Transparency in pricing is a hallmark of a reliable payment partner. For example, a provider with an instant payout payment gateway might charge a premium for this service, but the benefit of improved cash flow could outweigh the cost.

Avoiding Common Mistakes When Choosing a Payment Gateway

Many businesses make critical errors when selecting a payment gateway. A common mistake is focusing solely on the lowest cost, which can lead to hidden fees and limited features. Ignoring the importance of diverse payment methods can alienate a significant portion of your customer base. Neglecting to consider global reach from the outset can severely restrict a business’s ability to expand into new international markets. Overlooking hidden fees, such as chargeback or currency conversion charges, often results in unexpected expenses that can eat into profits. Rushing the decision without a thorough comparison can lead to operational disruptions and security risks.

Essential Checklist for Final Selection

Before making a final decision, use this checklist to thoroughly evaluate each potential provider:

Outline Business Needs: Clearly define your business model, target markets, and customer payment preferences.

Confirm Global Coverage: Verify the gateway’s ability to support your target regions and currencies.

Assess Integration Options: Evaluate the technical requirements and the ease of integrating the gateway with your current systems.

Review Reputation and Financial Health: Research the provider’s reputation and financial stability to ensure they are a reliable long-term partner.

Evaluate Security: Confirm that the provider meets or exceeds all relevant security and compliance standards.

Analyze Reporting: Ensure the gateway provides robust analytics and reconciliation capabilities for clear financial oversight.

Compare Fees: Conduct a comprehensive cost-benefit analysis, comparing all potential fees from different providers.

Maximizing Business Growth with the Right Payment Gateway

Enhancing Customer Experience and Retention

A well-chosen global payment gateway is a powerful tool for enhancing the customer experience. Customers expect instant payment confirmation, which builds trust and reduces anxiety. A gateway that offers features like automated billing and recurring payments provides convenience and encourages repeat purchases. The ability to handle currency conversion allows customers to view prices in their local currency, greatly enhancing the shopping experience and driving higher conversion rates.

Streamlining Operations Across Sales Channels

For businesses operating across multiple channels, a unified global payment gateway can streamline operations. Automation reduces manual data entry and minimizes human error, while unified commerce platforms aggregate data from all sales channels, providing a holistic view of the business. Real-time analytics offer valuable insights into customer behavior, allowing merchants to optimize conversions and improve operational efficiency. Robust data integration supports predictive modeling and better decision-making.

Adapting to Market Trends and Industry Insights

The payments industry evolves rapidly, with mobile payments, contactless options, and BNPL shaping consumer expectations. A leading global payment gateway like PayerMax adapts to these trends, offering solutions such as instant payout payment gateway for gaming and other industries.

Choosing a gateway that anticipates future trends helps businesses boost customer acquisition, strengthen security, and gain actionable insights for sustainable growth.

FAQ

How can a business ensure it can accept payments from customers all over the world?

A business can ensure it can accept payments globally by using a global payment gateway that supports a wide range of global payment methods. An effective solution provides access to numerous local card acquiring options and region-specific payment methods, which improves transaction success and customer satisfaction. PayerMax offers over 600 payment methods across 150 countries and regions.

How long does it take to integrate a payment gateway?

Integration time depends on the provider and platform. Most businesses complete setup within a few hours or days using API or plug-in solutions.